Money matters. So, if your financial health is currently in a less-than-perfect position, fixing this should be a priority. However, knowing how to improve the situation can be quite challenging.

While it does require consistency and hard work, building your strategy needn’t be difficult. Focus on the six simple steps below, and your finances will look a whole lot better.

1- Downgrade your car

When looking to make an instant impact, selling one of your biggest assets makes sense. You’re unlikely to sell your home unless your living situation has witnessed a dramatic change. However, a classic Porsche 911 appraisal should open your eyes to how much could be made from relinquishing the vehicle. You could pick up a decent car for a cheaper price while making further savings on insurance, gas, and repairs.

If nothing else, this move will put you in the right mindset to complete future upgrades too.

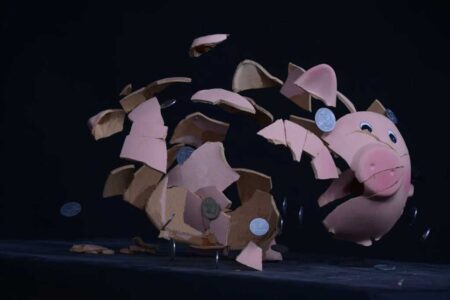

2- Declutter

Selling a big asset will get the ball rolling in style as you aim to enhance your immediate financial health. You can boost this further by selling some of the other possessions you no longer need. The average household contains unwanted items worth thousands of dollars. Whether you sell them online or focus on holding a garage sale doesn’t matter. You could generate a significant sum in no time.

The fact that you will additionally claw back valuable space at home is a bonus..

3- Address ongoing financial waste

Hoarding items isn’t the only source of financial waste you should focus on. While we are all pretty good at getting the best deals when making one-off purchases, many of us waste money on services. From switching your utilities supplier to losing subscriptions, several savings may be made. Better still, they are recurring. So, even if it’s only a small monthly saving, it’ll soon add up.

Making your money last longer in this way is highly effective.

4- Focus on your career earnings

Reduced outgoings will certainly have a positive impact on your financial health. Nevertheless, everything becomes easier when you have more income. If you are a business owner, this could mean focusing on financial efficiency within the company. If you’re an employee, the goal may be to negotiate a pay rise or start looking for another job. Either way, earning more money obviously aids your financial situation.

Launching a side hustle could be another way to boost your earnings.

5- Build for the future

Your financial health isn’t determined solely by the immediate future. It’s equally crucial to focus on long-term goals, not least because retirement serves up new challenges. Getting matched 401(k) contributions from your employer can make a huge difference. Meanwhile, a diverse investment portfolio can unlock improved financial situations. The earlier you start, the better. Even if you’re in your twenties.

The knowledge that your long-term future is stable will bring peace of mind.

6- Be organized

Finally, anyone who wants to improve their financial health must make a long-term commitment. After all, there is little point in being consistent with 80% of your financial decisions if the other 20% undo that progress. So, staying organized is pivotal. Spreadsheets, Apps, and other tools to track your financial health will make all the difference. They’ll help you avoid mistakes and stay motivated from seeing your progress.

When coupled with the understanding of what you want to achieve, success is assured.