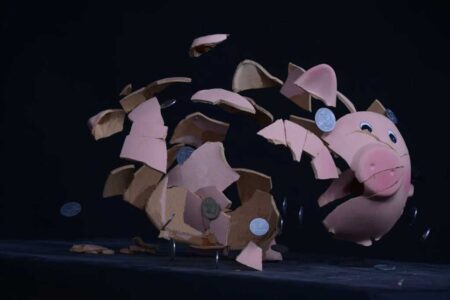

Financial assets have undergone a facelift in the past decade. For the first time, people are scratching their heads on how to divide crypto when they separate. Cryptocurrencies and NFTs (non-fungible tokens) have introduced a new layer of complexity to asset division during a separation or divorce. Traditional assets follow familiar legal and financial paths; these digital holdings are still relatively uncharted territory for many.

Here’s a clear, beginner-friendly guide to fairly and peacefully navigating this digital asset split.

Understanding What You’re Dividing

First things first: not all digital assets are created equal.

Cryptocurrency is considered a form of virtual currency. Bitcoin, Ethereum, Solana, and thousands of other tokens are stored in digital wallets and can fluctuate wildly in value. They’re often treated like investment property in legal terms.

NFTs, on the other hand, are unique digital items that represent ownership of art, music, collectibles, or other assets stored on the blockchain. Their value is even more subjective, tied closely to perceived demand and cultural value.

Both can be extremely valuable—and volatile—which makes understanding and documenting them essential.

Step 1: Identify and Disclose

The first step in any asset division process is transparency. Both parties should disclose all digital assets just like they would a 401(k) or a home. This means:

- Listing all owned cryptocurrencies and NFTs

- Noting the platform or wallet where they’re stored

- Providing transaction history, if possible

- Recording current market value

Don’t skip this. Hiding digital assets during a separation is not only unethical—it can lead to serious legal consequences.

Step 2: Determine What’s Marital Property

In many U.S. states, any asset acquired during the marriage—regardless of whose name it’s in—is typically considered marital property. That includes cryptocurrencies and NFTs, even if only one partner made the investment.

However, assets acquired before the marriage or received as gifts may be excluded. This is where having documentation comes in handy. The blockchain itself can be a powerful tool for establishing ownership history, as it offers transparent, timestamped records of every transaction.

Step 3: Valuing the Digital Assets

Because of their volatility, digital assets can swing in value dramatically over short periods. You’ll want to establish a valuation date—commonly the date of separation or the date of court proceedings—to freeze the assets’ value in time.

For high-value NFTs or complex portfolios, you might consider working with a digital asset appraiser. A professional can help estimate fair market value, especially for tokens that aren’t widely traded or easily converted into cash.

Step 4: Divide or Offset

Once values are established, you have a few options:

- Split the assets directly. If both parties are comfortable managing digital wallets, the simplest way may be transferring half of the assets to the other party.

- Offset with other property. One party keeps the crypto or NFT while the other receives an equivalent value in cash, real estate, or other marital assets.

- Sell and split proceeds. You can also liquidate the assets and split the funds, though this may involve taxes and transaction fees.

In many cases, divorce lawyers are now working closely with tech-savvy financial advisors to ensure fair and legal distribution of these digital assets. These collaborations are becoming increasingly important in modern separation proceedings.

Step 5: Stay Safe and Secure

Digital assets come with unique risks—most notably, theft or loss due to poor security practices. If you’re transferring or dividing crypto, use secure wallets, two-factor authentication, and confirm addresses multiple times.

If you’re unsure, consider using an escrow service or third-party platform that specializes in crypto settlements to handle the exchange securely.

Final Thoughts

Navigating a separation is never easy, but a clear plan for dividing digital wealth can remove one major stressor from the equation. By documenting every coin and collectible, agreeing on a valuation date, and leaning on experienced professionals when needed, you and your partner can turn a potential flashpoint into an orderly, transparent hand‑off. Crypto values may spike and dip, and NFT trends will come and go, but treating each other with fairness and respect will stand the test of time—long after the last blockchain confirmation clears.